The coronavirus is spreading rapidly, and economists now fear that it will have a major impact on the global economy. In the fashion and design industries, we’re seeing an immediate impact as annual events are canceled in New York, Europe and Asia. Besides the Met Gala, and high-end fashion shows, Milan-based Salone del Mobile and MIDO, the biggest furniture and eyewear fairs, have both been postponed from the spring until June. New York’s Architectural Digest Show, DIFFA Dining by Design and ICFF have all been canceled. In Chicago, the popular NEOCON design event was canceled too. The Shanghai Fashion Week and the Barcelona-based Mobile World Congress were also canceled.

Over the last century, recessions have almost always been started by a sustained period of higher interest rates. Never a virus: The damage such contagions inflicted on the world economy typically lasted no more than three months. Now, this once-in-a-century pandemic is hitting a world economy saddled with record levels of debt.

Central banks around the world are waking up to the prospect that the cash crunch can beget a financial crisis, as in 2008. That’s why the Federal Reserve took aggressive easing measures recently that were straight out of the 2008 crisis playbook. While it is unclear whether the actions of the Fed will be enough to prevent the markets from panicking further, it’s worth asking: Why does the financial system feel so vulnerable again?

Around 1980, the world’s debts started rising fast as interest rates began falling and financial deregulation made it easier to lend. Debt tripled to a historic peak of more than three times the size of the global economy on the eve of the 2008 crisis. Debt fell that year, but record low-interest rates soon fueled a new run of borrowing.

The easy money policies pursued by the Federal Reserve, and matched by central banks around the world, were designed to keep economies growing and to stimulate recovery from the crisis. Instead, much of that money went into the financial economy, including stocks, bonds and cheap credit to unprofitable companies. Shakin’ my head!!

As the economic expansion continued, year after year, lenders grew increasingly lax, extending cheap loans to companies with questionable finances. Today the global debt burden is again at an all-time high.

When markets fall, millions of investors feel less wealthy and cut back on spending. The economy slows. The bigger markets get, relative to the economy, the larger this negative “wealth effect.” And thanks again to seemingly endless promises of easy money, markets have never been bigger. Since 1980 the global financial markets (mainly stocks and bonds) have quadrupled to four times the size of the global economy, above the previous record highs set in 2008. This is an unprecedented interruption in the economy and I suspect the effect may last for years.

There are school closures of some kind in 22 countries on three continents with hundreds of millions of students around the world facing upheaval, including 13 countries that have shut schools nationwide.

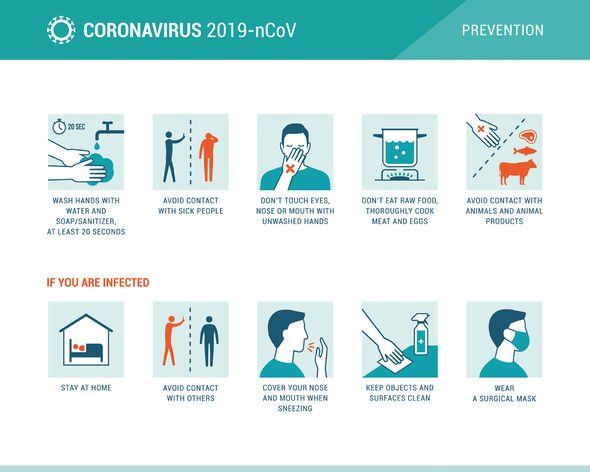

The United Nations has warned of the unparalleled scale and speed of the educational disruption being caused by the coronavirus. I think this generation of school-aged kids is going to morphe into new ‘social behaviors’ and lifestyles. No hugs, no handshakes and no contact will become the new norm. Why risk your health to fly somewhere to visit Grandma when you probably shouldn’t hug her anyway?

Currently, school closures due to the COVID-19 outbreak have disrupted the education of at least 290.5 million students worldwide, according to the United Nations Educational, Scientific and Cultural Organization.

Like many other industries, the fashion world has long embraced China as a source of cheap manufacturing — the country is by far the world’s largest producer of textiles, and it produces many of the other elements that go into clothes, from buttons to zippers to thread. The USA became very dependent, and we allowed it to happen because it was cost-efficient.

The Chinese have been the single biggest driver in luxury and fashion in the last 10 years. They comprise about one-third of all purchases of luxury, but they are more than 70% of the annual growth in luxury consumption. So there has been a disproportionate reliance for quite a few years in that consumer. This means it’s all a hot mess and fashion is going to take a big hit. Timing, prices and styles are all going to suddenly change – the demand will be for a hood and mask.

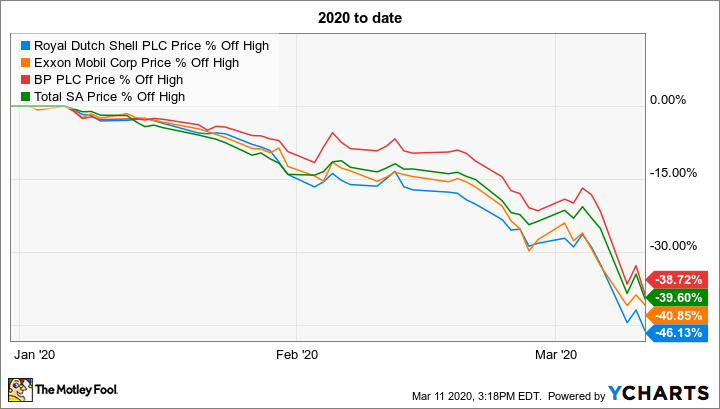

Oil prices have plunged more than 20% recently — their worst performance since 1991 — amid divisions between Russia and Saudi Arabia over production cuts. This could add further pressure on the global economy and lead to further downward revisions.

The oil price plunge makes things even worse for global GDP in the near term, as those who are hurt by the drop in oil prices (i.e. producers) typically react to the pain faster than those who benefit from it (i.e. consumers).

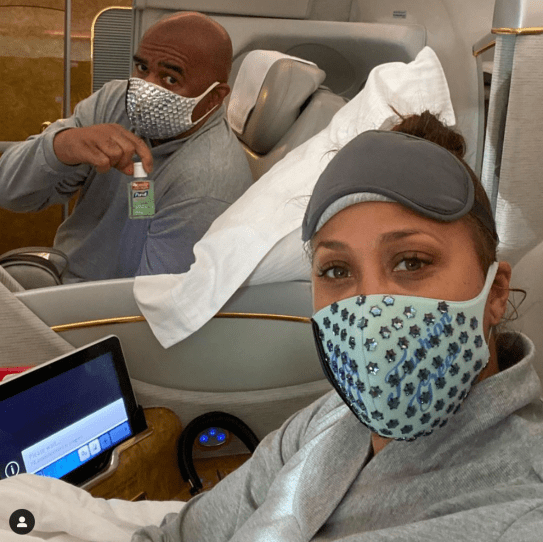

So too are industries tied to travel and tourism. Airlines, cruise lines, hotels; they all take a hit during outbreaks due to travel bans and warnings, and general fears — real or hyped — about contagion.